Health and Life Insurance

25Friday’s health and life insurance offer is comprised of 3 main products with different purposes and coverages. Please note that, except for life insurance, these products are available for all members of your direct family - spouse and children. You just need to provide us with the relevant documentation in a timely manner to include them in your policies.

Family Membership

If you don’t include a family member in the first 30 days of your work contract, you will only be able to add them during the annual renewal of our insurance contracts, which is on January 1st, with a grace period of 60 days. However, if you got married or had a child in the 60 days prior to adding a new member to the insurance policies, there is an exception to this rule, and you can add them earlier. In this case, a marriage, birth, or other applicable certificate is required.

Grace Periods

Most of the covered items have a grace period of 90 days. However, certain coverages have an extended grace period of 365 days, such as child labor or certain types of surgeries. Please check the detailed policy conditions to know the specific grace periods.

If you already had health insurance immediately before joining 25Friday, it is possible to bypass the grace periods for the same coverages and limits that you had before. To take advantage of these benefits, you are required to contact your previous health insurer and ask for the following documentation:

- Detailed information of the policy beneficiaries (e.g. yourself, spouse and children);

- Detailed information of the coverages and sub-limits;

- Start and end date of coverage.

MGEN - Main Insurance

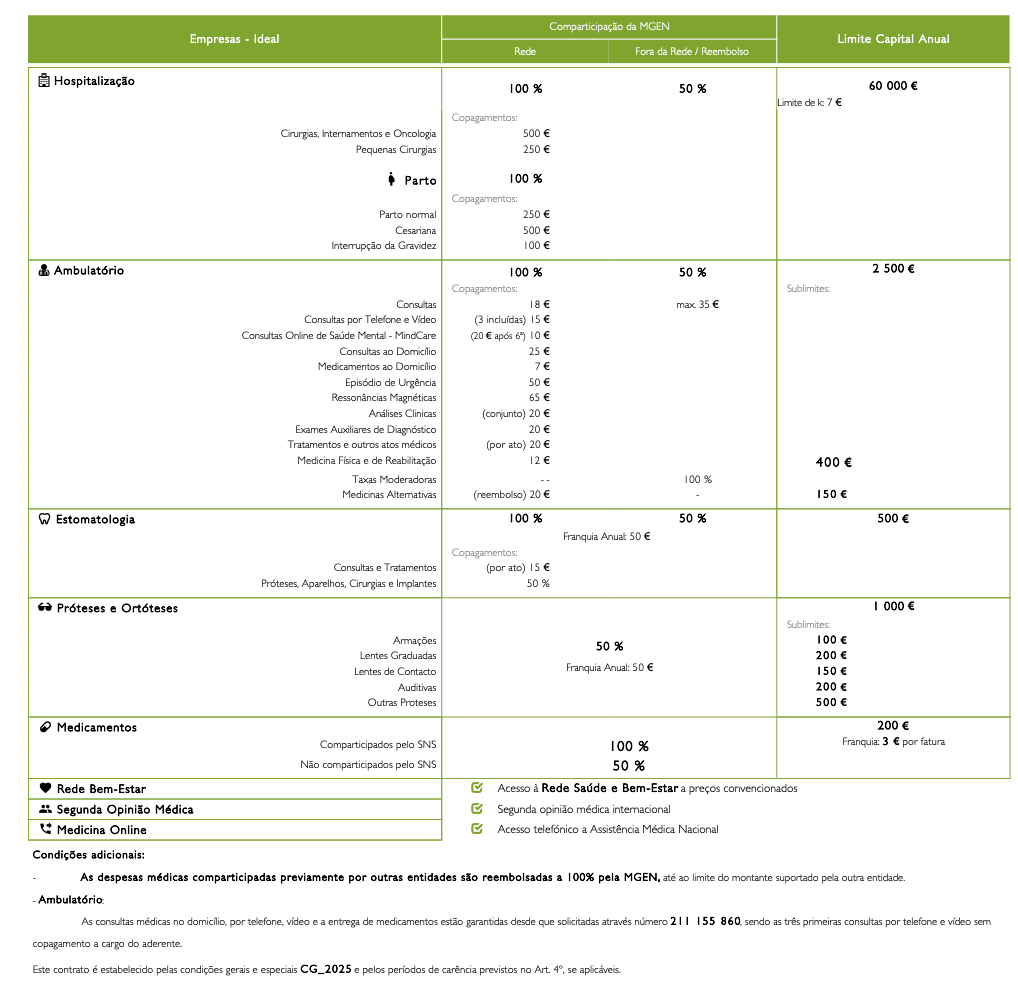

The main insurance is provided by MGEN - green card - and covers the day to day healthcare needs of you and your family through the healthcare network of AdvanceCare.

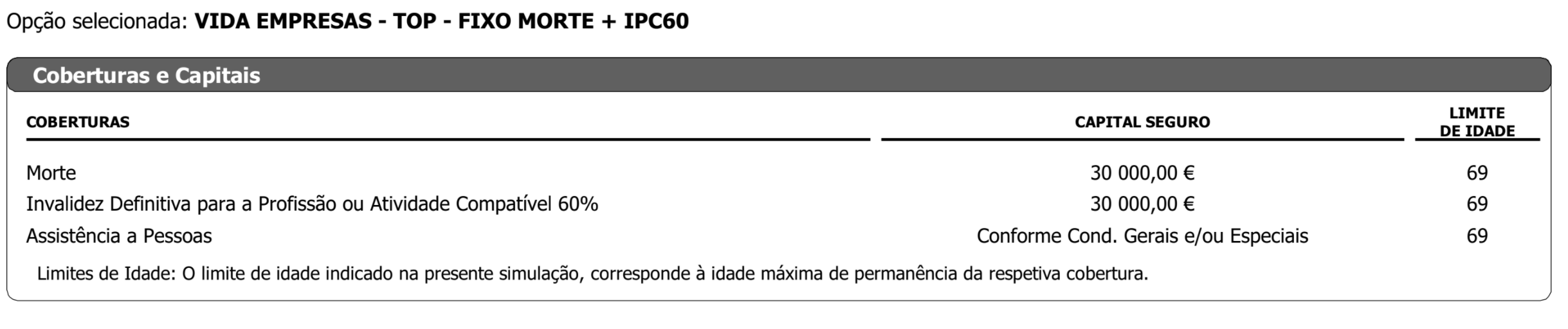

This insurance covers medical appointments, prescription glasses, dental care, and other items as detailed on the coverages’ table below.

Please create an account and register on both websites to better understand your insurance policies and submit claims.

Coverages

How to Use

In network:

- For any in network healthcare provider, simply show your green card to have access to the discounted rates.

Out of network:

- You need to submit a claim through the mobile App or website to be reimbursed. Please check that you have the correct card selected (MGEN/green) before submitting a claim.

Knok

A not-very-known but quite handy mobile application is Knok which you can download and use to book a video conference with a doctor of most specialities for free. Simply install it in your phone, register and use it.

Note that emergency medical appointments may be billed according to the general coverage conditions.

Caring by Eutelmed

MGEN offers a new and valuable benefit focused on mental health prevention and promoting quality of life in the workplace.

You have access to a complimentary preventive health platform called “Caring by Eutelmed,” designed to enhance well-being and improve the quality of life at work.

You only need to obtain the access code via email (they sent all this information to your personal e-mail) and enjoy free access to a platform with qualified psychologists and healthcare professionals, available 24/7.

The Caring by Eutelmed platform offers:

- Free access to a counseling hotline staffed by healthcare professionals.

- Tools to maintain and enhance mental well-being in both professional and personal life.

- Self-assessment of stress levels, anxiety, sleep quality, and more.

- Increased awareness of the challenges in balancing work and family life.

- This service does not use your available policy limit, and no co-payments are required.

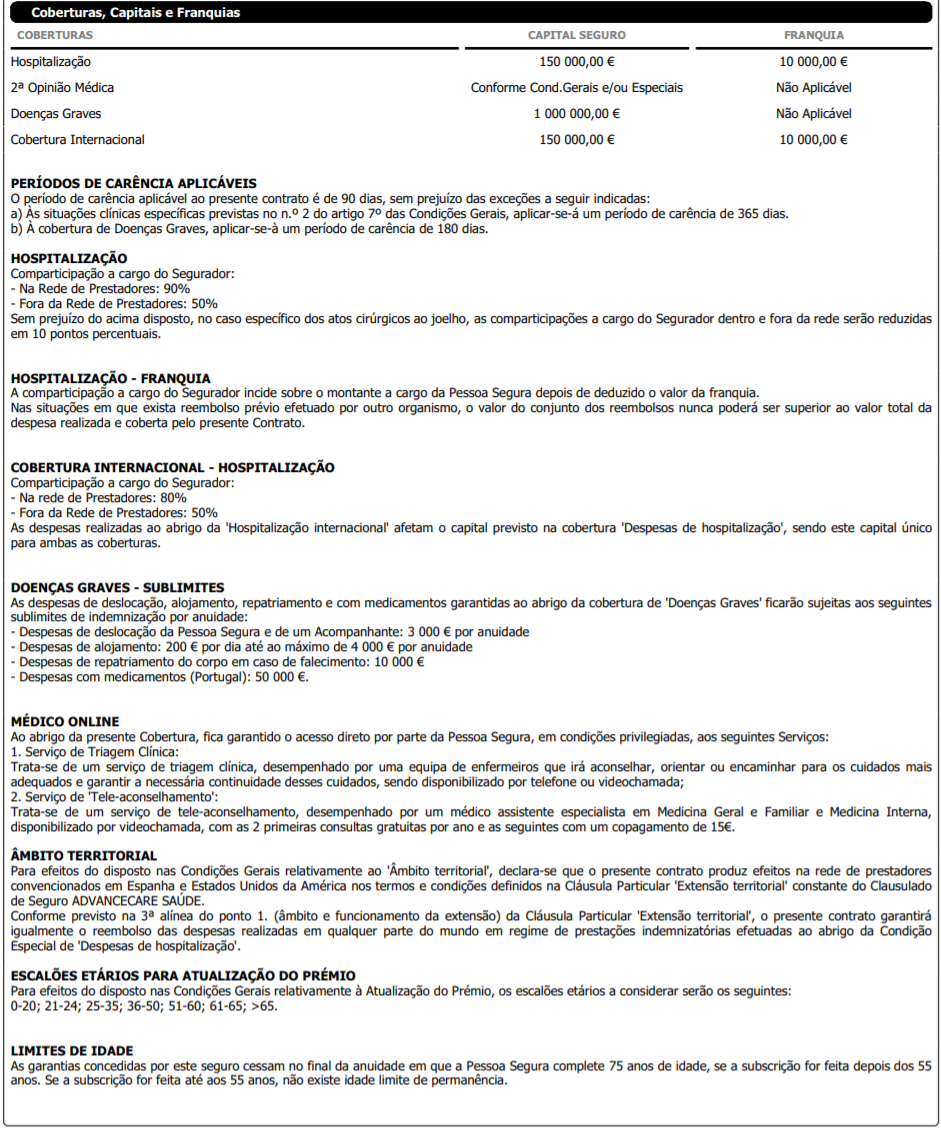

Tranquilidade - Serious Illness Insurance

This complementary insurance is also handled by the network of AdvanceCare and is meant to be used as last resort for very serious illness that need expensive and possibly out of country care. This is what your blue card is for.

Coverage includes tumors and organ transplants to name a few. We hope you don’t need it, but if you do, reach out to know more details regarding coverages.

Tranquilidade - Life Insurance

This complimentary insurance is meant to protect your family in the event of an incapacitating injury or death.